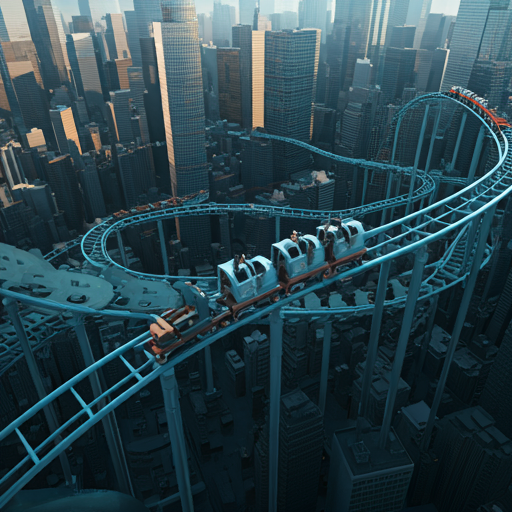

Navigating the Stock Market Rollercoaster: Tips for Investors

What Causes Market Fluctuations?

Market fluctuations are primarily driven by a variety of factors, including economic indicators, investor sentiment, and geopolitical events. Economic indicators, such as employment rates and inflation, provide insights into the overall health of the economy. These indicators can lead to changes in investor behavior, which in turn affects market prices. Understanding these dynamics is crucial for investors.

Investor sentiment plays a significant role in market movements. When investors fefl optimistic, they are more likely to buy stocks, driving prices up. Conversely, fear can lead to selling, causing prices to drop. This emotional aspect of investing is often underestimated. Geopolitical events, such as elections or international conflicts, can also create uncertainty in the markets. Such events can lead to rapid price changes.

In summary, market fluctuations are complex and influenced by multiple factors. Awareness of these factors can aid in making informed investment decisions. Knowledge is power in investing.

The Impact of Economic Indicators

Economic indicators serve as critical barometers for assessing the health of the economy. Metrics such as Gross Domestic Product (GDP), unemployment rates, and consumer price indices provide valuable insights into economic performance. These indicators influence investor confidence and market trends. Understanding their implications is essential for strategic investment decisions.

For instance, a rising GDP typically signals economic growth, prompting increased investment activity. Conversely, high unemployment rates may lead to market pessimism, resulting in sell-offs. This relationship between indicators and market sentiment is profound. Additionally, inflation rates can affect purchasing power and interest rates, further impacting investment strategies.

Investors must stay informed about these indicators. Knowledge of economic trends can enhance decision-making. Awareness is key in navigating market complexities.

Historical Trends in Market Volatility

Market volatility has been a defining feature of financial markets throughout history. It reflects the degree of variation in trading prices over time. Investors often feel anxious during these fluctuations. Understanding the causes of volatility is crucial. Economic indicators, geopolitical events, and market sentiment all play significant roles. These factors can lead to rapid price changes. It’s essential to stay informed and adaptable.

Navigating this unpredictable landscape requires a strategic approach. Diversification can help mitigate risks. A well-balanced portfolio is vital for long-term success. Emotional reactions can lead to poor decisions. Staying calm is key during turbulent times. Remember, patience often pays off. Investors should focus on their long-term goals. This mindset can provide clarity amid chaos.

Investment Strategies for Uncertain Times

Diversification: Spreading Your Risk

Diversification is a fundamental principle in risk management. It involves allocating investments across various asset classes. This strategy reduces exposure to any single investment’s volatility. A well-diversified portfolio can withstand market fluctuations. Investors should consider equities, bonds, and alternative assets. Each asset class reacts differently to economic changes. This balance can enhance overall returns.

In uncertain times, strategic asset allocation becomes crucial. Investors may want to increase their holdings in defensive sectors. These sectors typically perform better during downturns. Additionally, incorporating international assets can provide further stability. Global markets often behave independently. This can mitigate risks associated with domestic economic shifts. A diversified approach is essential for long-term resilience.

Long-Term vs. Short-Term Investing

Long-term investing focuses on capital appreciation over several years. This strategy often involves lower transaction costs. Investors benefit from compounding returns. In contrast, short-term investing aims for quick gains. It requires active management and frequent trading. This can lead to higher costs and tax implications.

Consider the next factors when choosing a strategy:

Both strategies have their merits. Long-term investing is generally less stressful. Short-term investing can be exciting and dynamic. Each approach requires careful planning and discipline. Choose what aligns with your financial goals.

Utilizing Stop-Loss Orders

Utilizing stop-loss orders can significantly enhance risk management. These orders automatically sell a security when it reaches a predetermined price. This mechanism helps limit potential losses in volatile markets. He can set these orders based on his risk tolerance. By doing so, he protects his capital from significant downturns.

Moreover, stop-loss orders can reduce emotional decision-making. Investors often struggle with fear and greed. A predetermined exit strategy provides clarity and discipline. It allows him to focus on long-term goals. Additionally, he can adjust stop-loss levels as market conditions change. This flexibility is crucial in uncertain times. Understanding this tool is essential for effective investing.

Emotional Resilience in Investing

Recognizing Emotional Triggers

Recognizing emotional triggers is vital for successful investing. Emotional responses can lead to irrational decisions. He must identify specific situations that provoke anxiety or excitement. Common triggers include market volatility, news events, and peer influence. Understanding these factors helps him maintain composure.

To build emotional resilience, he can adopt several strategies:

These approaches can mitigate impulsive reactions. He should regularly review his portfolio to stay aligned with his strategy. This discipline fosters a more rational mindset. Emotional awareness is crucial for long-term success.

Developing a Rational Infestment Mindset

Developing a rational investment mindset is essential for success. He must prioritize logic over emotion when making decisions. This plan of attack helps him navigate market fluctuations effectively. To cultivate this mindset, he can implement several strategies.

First, he should establish clear investment goals. These goals provide direction and purpose. Next, he can conduct thorough research before making any investment. Knowledge is a powerful tool. Additionally, he should maintain a diversified portfolio. This reduces risk and enhances stability.

Regularly reviewing his investment strategy is also crucial. It allows him to adjust based on performance and market conditions. Staying disciplined is key to avoiding impulsive actions. A rational mindset fosters long-term growth and resilience.

Practicing Patience and Discipline

Practicing patience and discipline is crucial in investing. He must resist the urge to react impulsively to market changes. This approach allows for more informed decision-making. By maintaining a long-term perspective, he can avoid emotional pitfalls. Short-term fluctuations often distract investors from their goals.

To cultivate patience, he can set specific timeframes for his investments. This helps him stay focused on the bigger picture. Additionally, he should establish rules for buying and selling. Consistency in following these rules is essential.

Regularly reviewing his progress can reinforce discipline. It provides an opportunity to assess performance objectively. Staying committed to his strategy fosters confidence. A disciplined approach ultimately leads to better investment outcomes.

Leveraging Technology and Tools

Using Analytical Tools for Market Insights

Using analytical tools for market insights is essential for informed decision-making. He can leverage various technologies to enhance his investment strategies. Tools such as technical analysis software provide valuable data on price trends. This information helps him identify potential entry and exit points.

Additionally, fundamental analyxis tools allow him to evaluate a company’s financial health. He can assess metrics like earnings per share and price-to-earnings ratios. These insights guide his investment choices.

Moreover, utilizing market sentiment indicators can reveal investor behavior. Understanding market psychology is crucial for anticipating price movements. He should regularly integrate these tools into his analysis. This practice enhances his ability to make data-driven decisions.

Automated Trading Systems

Automated trading systems offer significant advantages in the financial markets. These systems execute trades based on predefined algorithms. He can set specific parameters for entry and exit points. This automation reduces emotional decision-making during trading.

Furthermore, automated systems can analyze vast amounts of data quickly. They identify patterns and trends that may not be visible to human traders. This capableness enhances the potential for profitable trades .

Additionally, backtesting features allow him to evaluate strategies using historical data. He can refine his approach before deploying real capital. Regular monitoring of system performance is essential. This ensures that the algorithms remain effective in changing market conditions. Automated trading can wtreamline his investment process significantly.

Staying Informed with News Aggregators

Staying informed with news aggregators is crucial for investors. These platforms compile financial news from various sources. He can access real-time updates on market trends and economic indicators. This information helps him make timely investment decisions.

Moreover, news aggregators often provide customizable alerts. He can set notifications for specific stocks or market events. This feature ensures he never misses critical info.

Additionally, many aggregators offer analytical tools and insights. These resources can enhance his understanding of market dynamics . By leveraging these tools, he can stay ahead of market movements. Regularly reviewing aggregated news is essential for informed investing.

Learning from Past Market Crashes

Case Studies of Major Market Crashes

Case studies of major market crashes provide valuable insights. Historical events like the 1929 Great Depression illustrate the impact of speculation. He can analyze the factors that led to such downturns. Excessive leverage and lack of regulation were significant contributors.

Another example is the 2008 financial crisis, driven by subprime mortgage failures. This event highlighted the dangers of poor risk assessment. He should recognize the importance of due diligence in investing.

By studying these crashes, he can identify warning signs. Understanding market psychology during downturns is crucial. Investors often panic, leading to further declines. Learning from past mistakes can enhance his investment strategy.

Lessons Learned from Historical Events

Lessons learned from historival events are invaluable for investors. Analyzing past market crashes reveals critical insights. For instance, the 1929 crash was fueled by rampant speculation. He should recognize the dangers of over-leveraging.

Key takeaways include:

The 2008 financial crisis emphasized the importance of due diligence. Poor risk management practices were significant contributors. He must remain vigilant and informed. Understanding these lessons can enhance his investment strategy.

Preparing for Future Market Downturns

Preparing for future market downturns requires strategic planning. Historical market crashes provide essential lessons for investors. He should focus on building a diversified portfolio. This approach reduces exposure to any single asset class.

Additionally, maintaining an emergency fund is crucial. It provides liquidity during turbulent times. He must also regularly review his investment strategy. Adjustments may be necessary based on market conditions.

Implementing stop-loss orders can further protect his investments. These orders limit potential losses during downturns. Staying informed about economic indicators is vital. Knowledge empowers him to make timely decisions.